2021 Shared Value Awards Finalists

We are excited to announce the Hong Kong finalists of the Shared Value Awards 2021.

We are excited to announce the Hong Kong finalists of the Shared Value Awards 2021.

Shared Value Initiative Hong Kong welcomes a new Member: Sedgwick Richardson, a consultancy headquartered in Hong Kong.

Let’s read how CLP develops a young talent pool in Hong Kong to face the challenge of increasing retirement rates among its workforce coupled with stagnating intakes of student engineers.

溢达集团是一家扎根于香港、由家族所有的纺织及成衣公司,业务遍佈中国、越南和斯里兰卡,雇用全球超过3万5千名员工。作为全面的服务和解决方案提供商,溢达透过投资于公司员工和创新科技,确保「从棉种到衬衫」过程的可持续制造,将公司从其他制造商中区分开来。

OPEN EVENT – Gaëlle Loiseau, CEO of Shared Value Initiative Hong Kong, and Martina Mok, Head of Programmes & Partnerships, SVIHK, have been invited by the AmCham to present Creating Shared Value. They will provide relatable examples of how businesses in China, Asia and the rest of the world are adopting Shared Value to build high and sustainable performance in these challenging times.

Shared Value Initiative Hong Kong welcomes its first SME member: JEB Group, headquartered in Hong Kong and a provider of innovative solutions for corporate and commercial environments. Discover with Sam Beere, JEB’s General Manager, how the group started its journey to Creating Shared Value.

在这次访谈中,卓佳集团的集团总法律顾问兼首席合规官、以及共亨价值计划香港的总监黄德君小姐(Judy Wong)解释卓佳如何以目的工作组合解决痛点为目标,以及这种前瞻性的做法如何帮助他们渡过疫情。

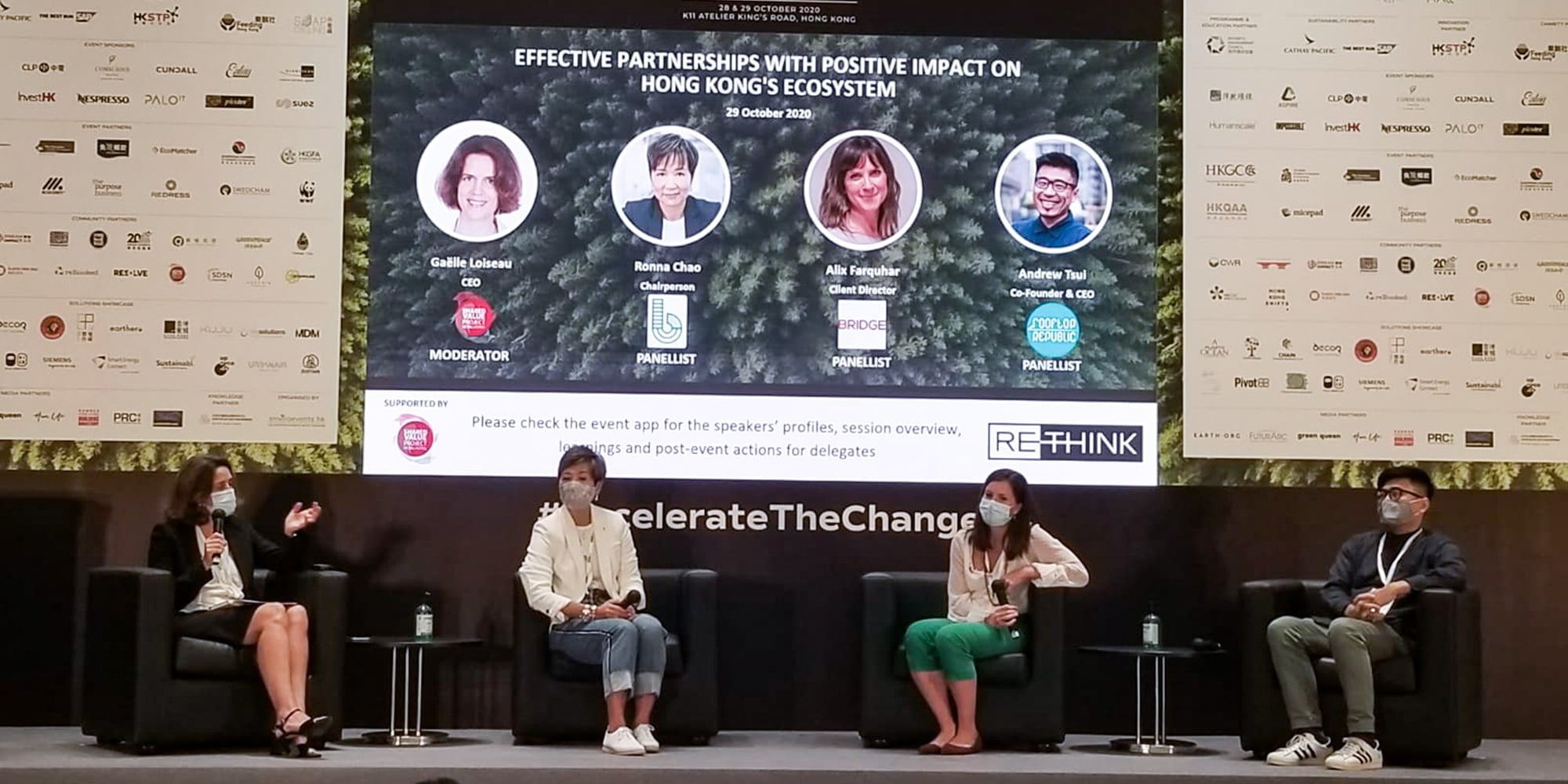

ReThink, Hong Kong’s sustainability forum held 28-29 October, set itself a high bar by asking from the outset, how can we help businesses accelerate change towards a more sustainable future? Moderated by SVIHK CEO Gaëlle Loiseau, the panel ‘Effective partnerships with positive impact on Hong Kong’s ecosystem’, dug deep into this question by focusing on the ‘how’, and recognising that attempting change at scale in isolation is futile unless players join together for greater impact and intentional Shared Value.

As a sustainability professional, I often heard versions of the same message: “sustainability is for rich companies that have money to spare”. Over the years, this outlook has changed in part due to greater exposure to climate risks. Before we truly understood the magnitude of the Covid pandemic, the World Economic Forum Global Risks Report’s top risks in terms of likelihood and impact heavily featured environmental issues.

In 2018, Novetex launched The Billie System in Tai Po, Hong Kong. With this sustainable initiative, the company upcycles textile waste into new yarn, thereby creating competitive advantage while addressing a pressing environmental issue.

By aligning profit with purpose, Mountain Hazelnuts (MH) aims to capture 3% of the US$7 billion global hazelnut market and expects to significantly increase the income of 15% of Bhutan’s population.

There are increasing numbers of headlines putting sustainability into the frame for corporates to consider. This assumes that it hadn’t been a part of discussions prior to Davos’ and the launch of Green Finance. This is misleading. The current relevance is actually due to the change to its materiality and the rising risk in doing business.